Pre-Employment Accounting Assessment: Hire Smarter and Reliable Accountants

Key Takeaways

- Pre-employment accounting assessments help HR teams objectively evaluate candidates’ technical and analytical abilities before hiring.

- These tests measure essential accounting competencies such as financial analysis, bookkeeping, and compliance.

- Using structured accounting assessments ensures unbiased hiring decisions and better workforce performance.

- Skillrobo simplifies pre-employment testing through automated, customizable accounting assessments for every role.

Introduction

A recent research reveals that the demand for qualified and skilled accounting professionals remains high all through 2025. Furthermore, most finance and accounting positions tracked by the US Bureau of Labor Statistics have seen unemployment rates that are much lower than the May 2025 national rate of 4.2%. This means that companies must compete for the same limited pool of qualified candidates.

How do you stay ahead of the curve? Having a streamlined pre-employment accounting screening process is a good place to start. A pre-employment accounting assessment helps HR teams evaluate the skills and competencies of accounting professionals for various positions. When candidates are screened through an accounting pre-employment test, the likelihood of finding the right fit for the role increases manifold.

What is a pre-employment accounting assessment? How to evaluate accounting skills before hiring? This blog explores what an accounting skills test for hiring entails, the key components of a pre-employment accounting test, its key benefits, the essential skills it measures, and how tools like Skillrobo help HR professionals build efficient, bias-free hiring workflows for accounting roles.

What is a Pre-Employment Accounting Assessment

Recruiting the right accounting professionals is crucial for any organization’s financial health. Accountants play a vital role in ensuring accuracy, compliance, and financial efficiency, and a single hiring mistake can lead to costly errors. While resumes and interviews reveal some information, they cannot fully assess a candidate’s ability to manage financial data, analyze statements, or apply accounting principles correctly. This is where pre-employment accounting assessments come into play.

A pre-employment accounting assessment is a structured test designed to evaluate candidates’ practical accounting skills and knowledge before hiring. It provides employers with measurable insights into how well a candidate understands concepts such as financial reporting, reconciliation, journal entries, and taxation. By integrating such assessments into the hiring process, companies ensure that every candidate is evaluated fairly and accurately based on merit and capability rather than subjective impressions.

An accounting pre-employment test is a comprehensive test that is designed to evaluate a candidate’s technical and analytical skills related to accounting and finance. It assesses their ability to apply accounting principles, interpret data, and make accurate financial decisions.

The test typically includes both theoretical and practical questions that cover a wide range of areas, from bookkeeping and financial reporting to cost accounting and compliance. Many assessments also include scenario-based or case-study questions that simulate real-world challenges accountants face in their daily work.

Unlike traditional interviews, these assessments focus on performance and problem-solving rather than opinions or self-reported experience. They are often delivered online, allowing employers to evaluate multiple candidates quickly and objectively.

Why Pre-Employment Accounting Tests Are Important in the Hiring Process

Hiring accountants requires far more than verifying qualifications and experience. Accounting professionals manage critical business functions, such as recording financial transactions, reconciling statements, preparing reports, and ensuring compliance with tax and regulatory standards. Any lapse in accuracy, ethics, or financial understanding can have a direct impact on an organization’s profitability, legal standing, and reputation.

Pre-employment accounting assessments have emerged as a vital component of the hiring process because they bring structure, transparency, and objectivity to candidate evaluation. They ensure that hiring decisions are based on verifiable skill data rather than assumptions, impressions, or academic credentials alone. Let’s explore in detail why these tests are indispensable for modern finance and HR teams.

1. Verifying Technical Competence Beyond the Resume

Resumes often highlight academic qualifications and work experience, but they don’t reveal a candidate’s real ability to apply accounting principles under practical conditions. Many applicants may have theoretical knowledge but struggle with real-world financial problems such as reconciling complex ledgers or analyzing variances in statements.

A pre-employment accounting test bridges this gap by measuring actual proficiency in bookkeeping, journal entries, financial reporting, and software usage. It helps employers confirm that candidates can translate their knowledge into accurate, actionable results. This ensures that the hired individual can handle critical accounting functions from day one without extensive supervision or retraining.

2. Identifying Analytical and Numerical Aptitude

Accountants do much more than record numbers, they analyze financial data, detect irregularities, and provide insights that drive business decisions. Analytical thinking, numerical accuracy, and logical reasoning are fundamental to success in any accounting role.

Pre-employment accounting assessments evaluate these competencies through problem-solving and scenario-based questions that test the candidate’s ability to interpret data, forecast outcomes, and apply quantitative reasoning. This helps HR teams identify individuals who possess not just technical skills but also the analytical mindset necessary for strategic financial planning.

3. Ensuring Accuracy and Reducing Financial Risk

Even minor accounting errors can lead to significant financial discrepancies, compliance issues, or misinformed decision-making. Pre-employment accounting tests act as a safeguard by evaluating a candidate’s attention to detail, precision, and consistency.

For instance, tests often include sections on reconciliation, data verification, and error detection, enabling employers to assess how well candidates handle meticulous financial work. By hiring individuals who demonstrate accuracy and diligence, companies minimize risks of audit failures, reporting mistakes, and financial misstatements that could damage their credibility.

4. Streamlining Recruitment Through Data-Driven Decisions

In traditional recruitment, evaluating accounting talent is time-consuming and prone to human bias. Interviews alone may not reveal skill gaps or performance weaknesses, especially when candidates have strong communication skills but limited technical depth.

Pre-employment assessments provide standardized, quantifiable data that allows hiring managers to compare candidates objectively. The scores and analytics generated from these tests help shortlist high performers quickly, enabling faster and more confident hiring decisions. This data-driven approach reduces subjectivity, accelerates recruitment, and improves overall hiring accuracy.

5. Enhancing Fairness and Eliminating Bias in Hiring

Bias in recruitment, whether conscious or unconscious, can influence decision-making and lead to unfair or inconsistent evaluations. Pre-employment accounting tests promote fairness by standardizing the assessment process. Each candidate faces the same questions and scoring system, ensuring equal opportunity and objective evaluation.

This approach benefits both employers and job seekers. Employers gain confidence that their hiring decisions are based purely on skill and performance, while candidates appreciate the transparency and fairness of a merit-based selection process.

6. Reducing Training and Onboarding Costs

Hiring the wrong candidate not only affects performance but also leads to increased training and rehiring expenses. When candidates are evaluated using pre-employment assessments, employers can be confident that the selected individuals already possess the necessary competencies for the role.

By identifying skill gaps early, organizations can focus their onboarding programs on advanced training rather than basic instruction. This saves time and resources while enabling new hires to contribute productively sooner.

7. Improving Long-Term Employee Retention

Employees who are hired based on skill alignment and role suitability tend to perform better and stay longer. Pre-employment assessments ensure that candidates’ abilities and expectations match the responsibilities of the role, leading to higher job satisfaction and lower turnover.

When employees feel competent and confident in their roles, they are more engaged and motivated. This creates a ripple effect of higher productivity, stronger team collaboration, and overall financial stability.

8. Strengthening Compliance and Ethical Standards

Accounting departments operate under strict regulatory frameworks, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Pre-employment tests often include questions on compliance, auditing, and ethical practices, ensuring that candidates understand the legal and moral responsibilities of their position.

By assessing ethical awareness during the hiring process, organizations reduce the risk of non-compliance, fraud, and reputational damage. This helps maintain internal accountability and builds trust with clients, investors, and regulators.

9. Supporting Scalable and Remote Hiring

In today’s digital landscape, many organizations hire accountants remotely or across global locations. Pre-employment accounting assessments make this process scalable by enabling online testing and automated evaluation.

Whether hiring for one role or fifty, these assessments allow recruiters to maintain consistency, fairness, and quality across all applicants. The flexibility of remote assessments also attracts a wider talent pool and helps organizations find the best candidates regardless of geography.

10. Building a Stronger Financial Workforce

Ultimately, the goal of pre-employment accounting testing is to build a financially strong and reliable workforce. By using standardized assessments, organizations ensure that every accountant hired possesses the technical expertise, analytical ability, and ethical grounding necessary to manage business finances effectively.

This contributes to more accurate financial reporting, better compliance, and smarter decision-making across departments. It also strengthens the organization’s overall financial integrity and resilience in the long run.

In essence, pre-employment accounting assessments transform recruitment from a subjective process into a data-driven strategy that ensures only the most capable, precise, and ethical professionals join the finance team. By incorporating these tests, businesses safeguard their financial operations, promote fairness, and build a foundation of trust and excellence that sustains long-term success.

Key Skills Evaluated in Pre-Employment Accounting Assessments

A well-designed accounting test evaluates a mix of technical, analytical, and cognitive skills that are vital for accounting and finance roles. The following areas are commonly assessed:

- Basic Accounting Principles

Candidates must demonstrate an understanding of fundamental accounting concepts, including double-entry bookkeeping, accruals, and the accounting cycle. This ensures that they can manage financial data systematically and adhere to standard practices. - Financial Statements and Reporting

Knowledge of balance sheets, income statements, and cash flow statements is essential. The test evaluates the candidate’s ability to interpret and prepare accurate financial reports that comply with accounting standards. - Bookkeeping and Journal Entries

Accurate recordkeeping forms the backbone of accounting. Assessments test a candidate’s ability to record transactions, reconcile ledgers, and identify discrepancies efficiently. - Taxation and Compliance

Understanding tax laws, payroll calculations, and statutory compliance is critical for accountants in all industries. Tests often include practical tax scenarios that measure the candidate’s grasp of regional and national tax regulations. - Analytical and Numerical Reasoning

Accountants must interpret data and derive insights for decision-making. Numerical reasoning questions assess logical thinking, pattern recognition, and data analysis skills essential for forecasting and financial planning. - Financial Tools and Software Proficiency

Modern accounting relies heavily on digital tools. Assessments often include tasks using Excel, QuickBooks, or ERP systems to evaluate a candidate’s ability to perform automated accounting functions accurately. - Attention to Detail and Problem Solving

Accuracy is vital in accounting. Small numerical errors can lead to financial misrepresentation. The test measures how carefully candidates review data, identify anomalies, and solve problems efficiently.

How to Evaluate Accounting Skills Before Hiring

Evaluating accounting skills before hiring requires a structured, data-driven approach. Relying solely on interviews or resumes can overlook key competencies. Here are some effective ways to conduct fair and thorough assessments:

- Use Standardized Tests: Implement pre-employment accounting assessments that objectively evaluate knowledge, speed, and accuracy.

- Incorporate Role-Specific Scenarios: For example, cost accountants might be tested on budgeting, while financial analysts could be assessed on ratio analysis.

- Simulate Real Tasks: Use case studies and spreadsheet-based exercises that mirror everyday accounting challenges.

- Review Analytical Reports: Assess results quantitatively to identify top performers.

- Combine Assessments with Behavioral Insights: Evaluate soft skills such as integrity, teamwork, and communication to ensure cultural fit.

This comprehensive evaluation process ensures that employers hire accountants who not only possess technical expertise but also align with organizational goals.

Benefits of Using Accounting Skill Tests in Hiring

Incorporating pre-employment accounting assessments offers multiple benefits for organizations seeking to hire qualified financial professionals:

- Objective Hiring Decisions – Tests eliminate subjective bias, ensuring every candidate is evaluated on the same criteria.

- Faster Screening Process – Automated assessments quickly identify the most capable applicants, reducing manual workload for recruiters.

- Enhanced Quality of Hires – Candidates who perform well in assessments are more likely to succeed in real accounting roles.

- Reduced Training Costs – Pre-screened employees require less onboarding and training time.

- Legal and Compliance Assurance – Structured, standardized testing ensures fair and compliant recruitment processes.

- Increased Team Efficiency – Hiring the right professionals leads to smoother operations, better accuracy, and higher productivity.

Streamline your Pre-employment Assessments with Skillrobo

How to Design an Accounting Assessment for Recruitment

Designing an effective accounting assessment involves creating a balanced test that accurately reflects the requirements of the job. The following steps ensure a fair and insightful evaluation:

- Define Role Requirements: Identify the specific accounting functions (such as accounts payable, auditing, or financial analysis) that need testing.

- Select Appropriate Question Types: Include multiple-choice, numerical, and scenario-based questions to assess both knowledge and application.

- Incorporate Skill Weightage: Assign higher weightage to critical skills like reporting or taxation depending on the job profile.

- Ensure Real-World Relevance: Include practical exercises using real datasets or case scenarios for accurate skill measurement.

- Use Adaptive Testing: Employ dynamic assessments that adjust difficulty based on candidate performance for deeper insight.

These best practices ensure that the assessment is both comprehensive and relevant, leading to more reliable hiring outcomes.

How Skillrobo Simplifies Pre-Employment Accounting Assessments

Designing the perfect accounting knowledge test could be elusive without the right pre-employment assessment tools. Skillrobo offers a powerful platform that automates and simplifies accounting skill evaluations. It enables HR professionals to design, customize, and administer assessments that are both efficient and accurate. HR teams can choose from a variety of skill evaluations in the Skill Library. For accounting skills evaluation Skillrobo provides a comprehensive assessment that helps narrow down on skilled and competent candidates.

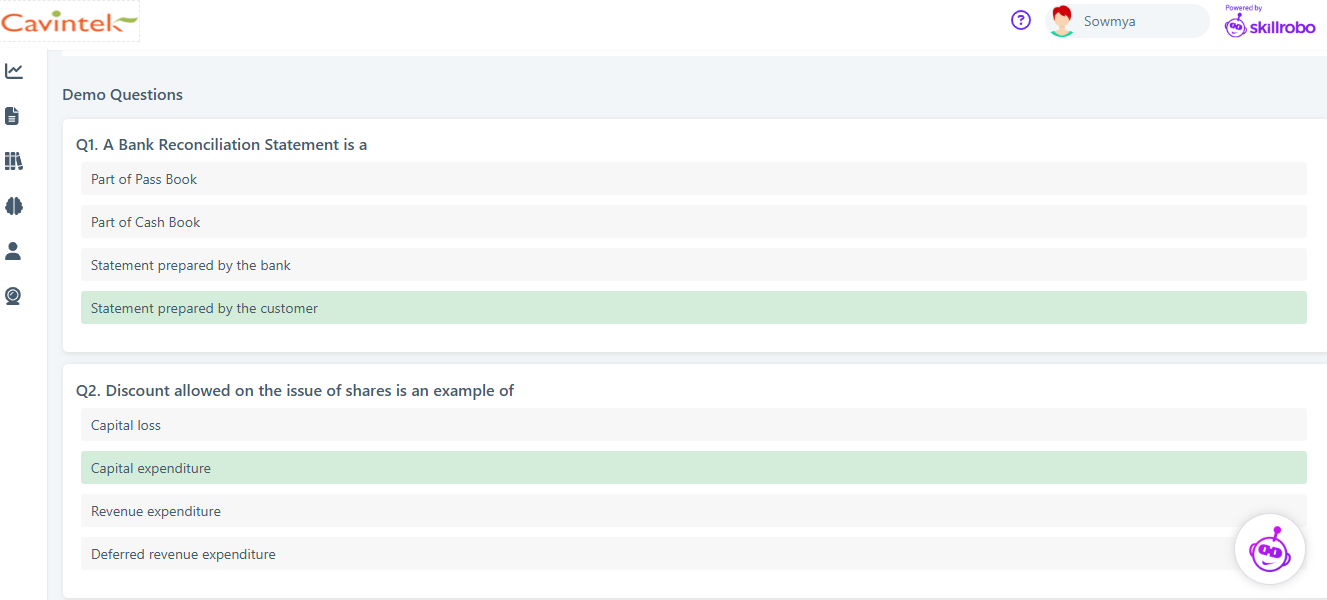

Sample Test for Accounting Roles

Key Differentiators

- Customizable Test Library: Create accounting tests tailored to specific job roles, from entry-level bookkeepers to senior financial analysts.

- Objective Evaluation: Automated scoring eliminates bias and ensures that hiring decisions are purely merit-based.

- Real-Time Analytics: Provides comprehensive reports on candidate performance, highlighting strengths and areas for improvement.

- Role-Specific Skill Mapping: Align assessments with actual job requirements to ensure relevance and precision.

- Integration with HR Systems: Seamlessly connects with recruitment software for a unified hiring workflow.

- Improved Candidate Experience: Offers user-friendly testing interfaces that reflect professionalism and fairness.

- Bias-Free Hiring: Ensures diversity and equality by focusing solely on skill and performance data.

By using Skillrobo, organizations can streamline recruitment, reduce hiring risks, and ensure that only qualified, competent accountants join their teams.

Top 5 Pre-Employment Accounting Assessment Tools

Choosing the right pre-employment accounting assessment tool is crucial for ensuring accurate skill evaluation and fair hiring. The ideal platform should offer customizable tests, objective scoring, and analytics that help HR teams make informed decisions. Below are the top five tools that organizations can use to evaluate accounting professionals effectively.

1. Skillrobo

Skillrobo stands out as the leading pre-employment accounting assessment platform designed to simplify and standardize the hiring process. It empowers organizations to create custom accounting assessments that accurately evaluate technical and analytical skills across multiple levels, whether hiring entry-level accountants or senior finance professionals.

Skillrobo’s intelligent automation ensures complete objectivity and eliminates human bias from hiring decisions. The platform provides detailed reports that highlight candidate strengths, weaknesses, and skill gaps, helping employers make data-driven hiring choices. Its customizable test templates cover everything from bookkeeping and financial analysis to taxation, reconciliation, and compliance.

Key Features of Skillrobo:

- Customizable Assessments: Create tailor-made tests that align with specific accounting roles and job requirements.

- Data-Driven Insights: Comprehensive analytics dashboards provide deep insights into performance and skill proficiency.

- Bias-Free Evaluation: Automated scoring ensures transparent and equitable hiring decisions.

- Role-Specific Skill Mapping: Evaluate competencies such as financial reporting, cost analysis, and auditing with precision.

- Seamless Integration: Integrates smoothly with existing HR and applicant tracking systems.

- Improved Candidate Experience: Offers a clean, intuitive interface that reflects professionalism and fairness.

- Scalable for Teams: Suitable for small businesses, mid-sized firms, and enterprise-level finance departments.

2. Mercer | Mettl Accounting Aptitude Test

Mercer | Mettl provides a widely used accounting aptitude assessment designed to test numerical reasoning, logical thinking, and financial literacy. It evaluates core areas such as bookkeeping, reconciliation, and financial statement preparation.

The platform offers pre-built question banks along with adaptive testing features that adjust difficulty based on candidate performance. Mettl’s analytics tools help HR teams benchmark results against industry standards for more objective comparisons.

Key Features:

- Role-specific question libraries for finance and accounting roles

- Adaptive testing for improved skill differentiation

- Real-time reporting and benchmarking capabilities

- Secure online proctoring for remote assessments

3. Adaface Accounting Skills Test

Adaface’s accounting test is designed to assess practical accounting knowledge and problem-solving ability. It focuses on evaluating candidates for real-world scenarios rather than purely theoretical knowledge.

This conversational AI-based platform engages candidates with situational questions that mimic real work tasks. It is particularly effective for screening junior and mid-level accountants who require strong practical and analytical skills.

Key Features:

- Conversational AI-based question delivery

- Role-based question banks covering financial statements, tax, and reporting

- Candidate-friendly test experience

- Automated scoring and analytics

4. TestDome Accounting and Finance Aptitude Test

TestDome offers pre-employment accounting and finance tests that measure numerical reasoning, financial reporting, and accounting software proficiency. Its tests are trusted by global organizations for assessing analytical and technical capabilities.

The platform includes scenario-based questions where candidates perform actual accounting operations in spreadsheets or simulated environments. This makes it especially useful for employers who want to evaluate task-specific competencies.

Key Features:

- Skill simulations using Excel and data sets

- Automatic grading and instant feedback

- Wide range of accounting and finance test modules

- Realistic, task-oriented assessments

5. Vervoe Financial Accountant Skills Assessment

Vervoe focuses on assessing candidates through role-based skill simulations that replicate real accounting tasks. The platform emphasizes performance over theoretical knowledge by testing candidates’ practical decision-making and accuracy.

Employers can use pre-built templates or create custom assessments that evaluate tasks like ledger reconciliation, financial analysis, and compliance management. Vervoe also provides automated ranking reports to help recruiters identify top performers instantly.

Key Features:

- AI-powered ranking and scoring of candidates

- Realistic, scenario-based skill testing

- Comprehensive question templates for financial accounting roles

- Seamless integration with ATS platforms

Unlock the true potential of your workforce

Wrapping Up

A pre-employment accounting assessment is a powerful tool for evaluating candidates’ technical and analytical capabilities before making hiring decisions. It ensures accuracy, fairness, and consistency in recruitment, helping organizations build skilled, trustworthy, and efficient accounting teams.

Skillrobo enhances this process through automation, customizable test design, and data-driven analytics. With its advanced features, HR teams can hire confidently, knowing that every candidate has been evaluated objectively. Implementing such skill assessments not only improves hiring quality but also strengthens the organization’s overall financial integrity and performance.

Frequently Asked Questions

1. What is a pre-employment accounting assessment?

It is a test that evaluates a candidate’s accounting knowledge, technical skills, and analytical ability before hiring to ensure suitability for financial roles.

2. Why are accounting assessments important in recruitment?

They help employers identify skilled candidates, reduce hiring bias, and ensure that new hires can perform accounting tasks accurately.

3. What skills are tested in a pre-employment accounting test?

Tests typically cover bookkeeping, financial reporting, taxation, auditing, compliance, and problem-solving abilities.

4. How can organizations design effective accounting assessments?

By including role-specific questions, real-world scenarios, and balanced question formats to measure both knowledge and practical application.

5. How does Skillrobo improve accounting assessments?

Skillrobo automates and customizes assessments, providing real-time analytics, fair evaluation, and seamless integration with recruitment systems for efficient and accurate hiring.